IMARC Group has recently released a new research study titled “United States Luxury Furniture Market Report by Raw Material (Wood, Metal, Glass, Leather, Plastic, Multiple, and Others), Application (Domestic, Commercial), Distribution Channel (Conventional Furniture Stores, Specialty Stores, Online Retailers, and Others), Design (Modern, Contemporary), and Region 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

United States Luxury Furniture Market Overview

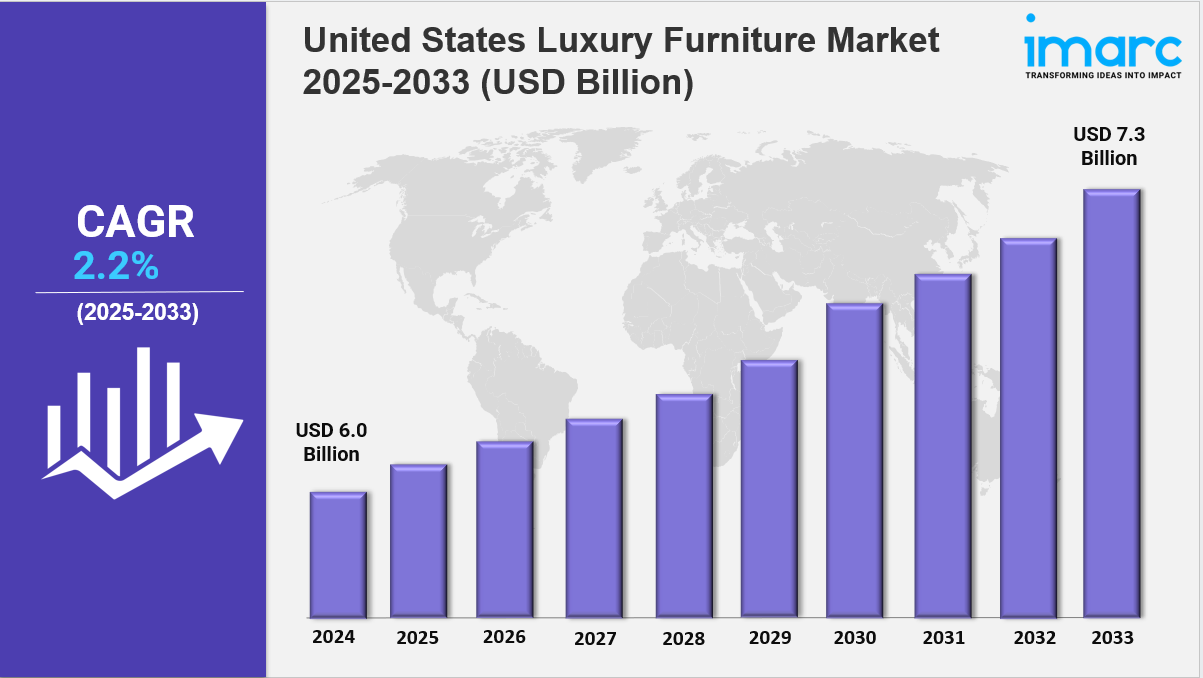

The United States luxury furniture market size reached USD 6.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.3 Billion by 2033, exhibiting a growth rate (CAGR) of 2.2% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 6.0 Billion

Market Forecast in 2033: USD 7.3 Billion

Market Growth Rate 2025-2033: 2.2%

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-luxury-furniture-market/requestsample

Key Market Highlights:

✔️ Rising disposable income and demand for premium home aesthetics fueling the luxury furniture segment

✔️ Growing trend of customization and artisanal craftsmanship in furniture design

✔️ Expanding online presence of luxury furniture brands enhancing consumer accessibility and sales

United States Luxury Furniture Market Trends

The U.S. luxury furniture market is undergoing a dramatic transformation, driven by a rising demand for sustainability, smart customization, and the convergence of tradition with cutting-edge technology. In 2024, a significant shift occurred as affluent consumers prioritized eco-conscious craftsmanship. High-end buyers increasingly seek furnishings made from reclaimed wood, FSC-certified timber, and low-VOC finishes. Circular design principles are now taking center stage, with artisans collaborating with biotech startups to develop carbon-negative materials—such as mushroom leather and algae-based resins—especially popular in environmentally progressive locales like Malibu and Miami.

This shift toward sustainability extends beyond raw materials. Supply chain transparency is now expected, particularly for pieces priced above $25,000. Blockchain-based tracking systems have become standard for provenance verification. Luxury brands like RH and Baker Furniture are now allocating 18–22% of their R&D budgets toward sustainable product innovation. This reflects growing consumer expectations, as MIT research found that 68% of affluent buyers are willing to pay a 30% premium for eco-friendly furnishings.

Bespoke Experiences Reimagined Through Hybrid Digital-Physical Customization

In 2024, advanced visualization tools are redefining the bespoke experience. The debut of 5D configurators—combining AR spatial mapping with tactile feedback—allows clients to digitally place furniture in their homes while receiving material samples via drone delivery. This blurs the line between online and showroom shopping.

Urban markets in the Northeast have reported a 41% surge in demand for custom sectional sofas, driven by AI-powered ergonomic design tools that optimize dimensions based on biometric family data. This fusion of wellness and tech has spawned a $2.7 billion smart luxury furniture submarket, featuring innovations such as climate-adaptive teak outdoor sets and self-cleaning velvet upholstery embedded with IoT sensors. Still, craftsmanship remains essential; a Q2 2024 survey found that 73% of buyers continue to value hand-carved details alongside digital features.

Market Segmentation Intensifies Amid Economic Polarization

Volatility in post-2024 interest rates has deepened segmentation in the luxury furniture space. The ultra-luxury segment—comprising pieces over $50,000—grew by 14% year-over-year, as billionaire clients commissioned high-art installations like kinetic tables and titanium-framed library ladders. In contrast, the "accessible luxury" tier ($15,000–$30,000) contracted by 8% amid budgetary tightening among upper-middle-class consumers. Brands like Restoration Hardware have responded by launching modular collections with upgradeable elements to meet evolving financial constraints.

New financing options are emerging to bridge the affordability gap. Art-backed leasing agreements now allow clients to pay monthly installments equivalent to just 2–3% of a piece’s appraised value. Regional preferences also highlight the market's diversity—Texas buyers are favoring oversized, opulent designs (up 22% year-to-date), while the Pacific Northwest leans minimalist and multifunctional (up 19%).

Growth and Trends in the United States Luxury Furniture Market Size

The evolving United States luxury furniture market size reflects a dynamic blend of heritage and innovation. Designers are increasingly merging traditional craftsmanship with digital precision. For example, luxury cushions now feature machine-rendered patterns hand-stitched onto premium fabrics like Bergamo silk, offering an aesthetic that’s both technologically advanced and artisanal.

Wellness features are becoming a standard component of high-end furniture. In 2025, over 25% of luxury orders included elements like posture-correcting chairs or antimicrobial, health-focused textiles. These choices underscore a broader movement toward products that promote both style and well-being.

Global trade tensions have also impacted material sourcing. With tariffs rising on imports like Chinese rattan, many manufacturers are pivoting to domestic options such as Appalachian white oak—both to control costs and reduce lead times. In urban environments like Manhattan, space-saving solutions are trending: built-in wine fridges within cabinets and furniture that doubles as sculpture are top sellers. Meanwhile, affluent rural homeowners are gravitating toward oversized, single-slab wood tables that function as both dining surfaces and status symbols.

Younger demographics are also shaping the market. Millennials now account for nearly half of all luxury furniture purchases, favoring authenticated “investment pieces” with blockchain provenance. Gen Z, on the other hand, seeks bold, limited-edition designs through artist collaborations and pop-up galleries—often discovered through social media.

Outlook: A Market Where Tradition and Disruption Coexist

The United States luxury furniture market size is on a strong growth trajectory, projected to surpass $48 billion by 2026. This momentum is driven by a potent mix of sustainable design, advanced technology, and shifting generational preferences. As long as luxury furniture brands continue to adapt—balancing craftsmanship with innovation—the market will remain resilient and robust for years to come.

Checkout Now: https://www.imarcgroup.com/checkout?id=20173&method=1190

United States Luxury Furniture Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest united states luxury furniture market report. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Breakup by Raw Material:

- Wood

- Metal

- Glass

- Leather

- Plastic

- Multiple

- Others

Breakup by Application:

- Domestic

- Living Room and Bedroom

- Kitchen

- Bathroom

- Outdoor

- Lighting

- Commercial

- Office

- Hospitality

- Others

Breakup by Distribution Channel:

- Conventional Furniture Stores

- Specialty Stores

- Online Retailers

- Others

Breakup by Design:

- Modern

- Contemporary

Breakup by Region:

- Northeast

- Midwest

- South

- West

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=20173&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

- Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145