In the world of foreign exchange (Forex) trading, one of the most common challenges faced by traders—especially aspiring professionals—is the lack of sufficient capital to trade effectively. While skill, strategy, and discipline are essential, the reality is that significant profits often require larger positions, which in turn demand more capital. This is where capital funding for forex traders becomes a game-changer, offering a practical solution to this financial barrier.

Capital funding programs, typically offered by proprietary trading firms (prop firms), allow traders to access large amounts of capital in exchange for a share in the profits they generate. This model not only empowers traders to scale their strategies but also provides firms with diversified income streams by leveraging the collective efforts of multiple skilled traders.

Understanding Capital Funding for Forex Traders

Capital funding for forex traders involves the provision of trading capital by third-party entities—usually prop firms—to individual traders. In this setup, the trader does not need to invest their own money beyond some initial assessment fees or challenge costs. Instead, the firm allocates a funded trading account once the trader has proven their capabilities through a selection or evaluation process.

This concept has revolutionized the accessibility of the Forex market. Traders from various backgrounds, regardless of their personal financial status, now have the opportunity to manage sizable accounts, sometimes ranging from $10,000 to even over $1 million. These funding models focus on performance metrics such as risk management, drawdown limits, and consistent profitability, rather than requiring collateral or credit scores.

How Capital Funding Works

The process typically begins with a challenge or evaluation stage. Prop firms use this phase to identify skilled traders. These evaluations involve trading on a demo account under real market conditions, with specific targets and rules:

-

Reach a profit target (e.g., 8% in 30 days)

-

Maintain a maximum drawdown (e.g., 10%)

-

Trade a minimum number of days to prove consistency

Once the trader passes the challenge, they are awarded a funded account. From there, they trade with the firm's capital and receive a portion of the profits—usually ranging between 70% to 90%—while the firm retains the remainder.

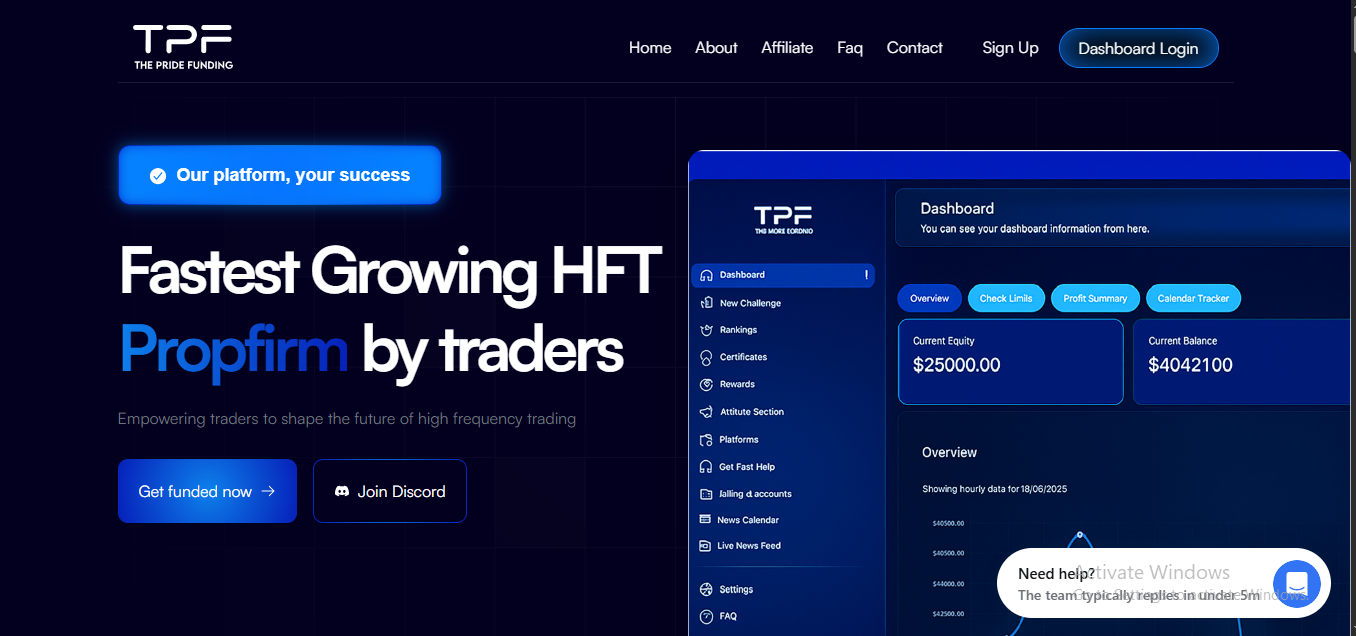

Some well-known firms in the industry offering capital funding for forex traders include FTMO, MyForexFunds (prior to its regulatory issues), The 5%ers, and FundedNext. These firms differ in their models, but the core idea remains: skilled traders get capital to trade, and both parties share in the profits.

Benefits of Capital Funding for Forex Traders

There are several compelling reasons why capital funding has become so popular among forex traders:

1. Access to Large Capital

Many talented traders lack the personal funds to generate meaningful profits from small accounts. A $1,000 account might yield only a few hundred dollars in monthly profits under proper risk management. With a $100,000 funded account, that same skillset can translate into thousands.

2. Limited Personal Risk

One of the biggest advantages is that traders risk very little of their own money. If they violate risk rules or perform poorly, they may lose the opportunity to continue trading the firm’s capital—but they don’t lose their own savings. This makes the model much safer for disciplined traders.

3. Professional Trading Environment

Capital funding introduces structure and discipline, as traders must follow strict risk management rules. This helps foster the habits needed to be a long-term professional trader, including maintaining consistency, avoiding overtrading, and managing losses.

4. Performance-Based Growth

Most prop firms offer scaling plans, which means that consistently profitable traders can receive larger accounts over time. This motivates traders to think long-term, building sustainable strategies rather than chasing quick profits.

Challenges and Considerations

Despite the benefits, traders should be aware of potential drawbacks and challenges in pursuing capital funding for forex traders.

1. Strict Rules and Targets

Passing an evaluation is not easy. The profit targets, time constraints, and risk limits can create pressure that leads to poor decisions. Even highly skilled traders sometimes fail due to these constraints.

2. Fees and Costs

Although traders are not risking large amounts of their own money, the evaluation challenges often come with fees—ranging from $100 to $1,000 or more depending on the account size. These are non-refundable unless specified (some firms offer refundable fees upon success).

3. No Guarantees

Passing an evaluation doesn't guarantee long-term success. Traders must maintain performance to continue managing the account. A few bad trades or violations of the firm’s rules can result in termination of the funded status.

4. Scams and Unreliable Firms

As the popularity of capital funding has grown, so have the number of unreliable or outright fraudulent firms. Traders must research thoroughly before partnering with a prop firm. Look for transparency, verified payout proof, and solid reputations within the trading community.

Tips for Success with Funded Accounts

To make the most of capital funding for forex traders, here are some key strategies:

-

Start with a Demo Challenge: Some firms offer free or low-cost demo challenges. Use these to test your strategy under firm conditions.

-

Focus on Risk Management: Always adhere to drawdown limits and daily loss limits. Many traders fail because they don't control risk.

-

Trade Consistently: Avoid gambling or oversized positions. Show consistency over time.

-

Treat It Like a Business: Just because it's someone else’s capital doesn’t mean it’s not real. Approach trading professionally.

-

Diversify Across Firms: Once you’re successful with one firm, consider applying to others. Managing multiple funded accounts can increase income and reduce reliance on a single source.

The Future of Forex Trading and Capital Access

The trend of capital funding for forex traders is likely to continue growing. With the global shift toward online opportunities and remote work, trading has become an attractive profession for people across all continents. Capital funding bridges the gap between talent and opportunity, democratizing access to financial markets.

Moreover, technology has enabled firms to monitor trader performance and risk in real-time, making it safer for them to allocate capital. This, in turn, allows them to attract more traders and scale their operations globally. For traders, this is the golden era to demonstrate skill and be rewarded with professional funding.

Conclusion

In conclusion, capital funding for forex traders opens a powerful path for individuals with talent but limited financial resources. By providing access to substantial trading capital and sharing profits, prop firms empower traders to focus on refining their strategies and maximizing returns without risking large sums of their own money. For those who can navigate the challenges and maintain discipline, this model offers a real opportunity to build a sustainable and rewarding career in Forex trading.