Market Overview 2025-2033

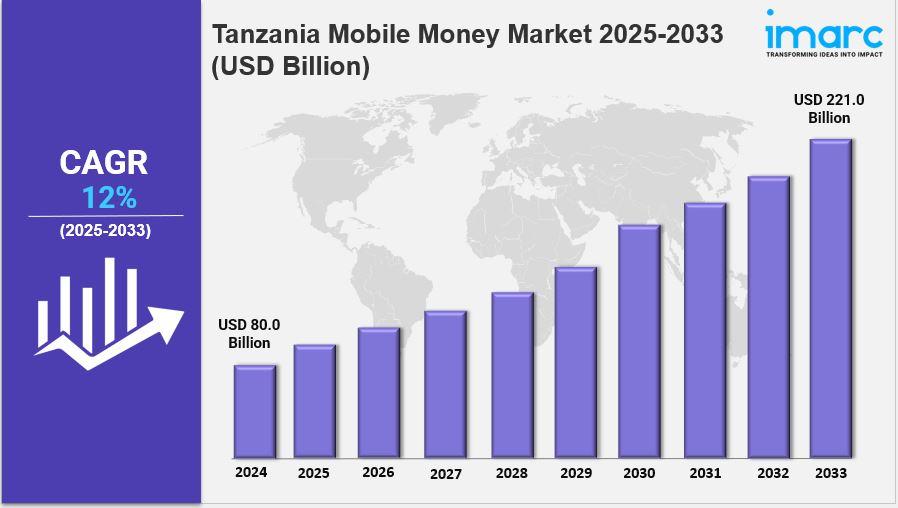

The Tanzania mobile money market size reached USD 80.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 221.0 Billion by 2033, exhibiting a growth rate (CAGR) of 12% during 2025-2033. The Tanzania mobile money market is witnessing significant expansion, fueled by increased smartphone penetration, a growing digital payment ecosystem, and rising financial inclusion efforts.

Key trends include the surge in person-to-person transactions and the integration of mobile money services with e-commerce platforms, as major players prioritize user-friendly interfaces and robust security measures.

Key Market Highlights:

✔️ Strong growth driven by increased smartphone usage and digital literacy.

✔️ Rising demand for seamless peer-to-peer transactions and financial services.

✔️ Growing emphasis on secure payment solutions and user-friendly interfaces.

Request for a sample copy of the report: https://www.imarcgroup.com/tanzania-mobile-money-market/requestsample

Tanzania Mobile Money Market Trends and Driver:

The Tanzania mobile money market is on an upward trajectory, reflecting a significant shift in how financial transactions are conducted across the country. As more individuals gain access to smartphones and the internet, the demand for mobile money services is surging.

This growth is driven by the increasing need for convenient and secure financial solutions, particularly in rural areas where traditional banking services may be limited. The integration of mobile money with everyday activities, such as purchasing goods and services, is becoming commonplace, further solidifying its role in the Tanzanian economy.

In 2025, the Tanzania mobile money market demand is expected to continue its robust expansion. Factors such as the rising population of tech-savvy youths and the growing acceptance of digital payments among small and medium-sized enterprises are contributing to this trend.

Additionally, the government's initiatives to promote financial inclusion and digital literacy are creating a favorable environment for mobile money providers. As a result, more users are likely to engage with mobile money platforms, driving up transaction volumes and service usage.

The Tanzania mobile money market forecast indicates a positive outlook, with projected growth rates surpassing previous years. Major players in the industry are focusing on enhancing their service offerings, including cross-border transactions and integration with international payment systems.

This strategic approach not only meets the evolving needs of consumers but also positions companies to capture a larger share of the market. Innovations in technology, such as blockchain and artificial intelligence, are also anticipated to play a crucial role in shaping the future of mobile money services in Tanzania.

Looking ahead, the Tanzania mobile money market outlook remains promising, with continued investment in infrastructure and technology. As competition intensifies, providers are likely to prioritize customer experience, offering tailored solutions that cater to diverse user needs.

With the ongoing emphasis on security and regulatory compliance, the market is set to mature, providing a stable foundation for sustained growth. Overall, the mobile money landscape in Tanzania is poised for transformation, driven by evolving consumer preferences and technological advancements.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=1448&flag=C

Tanzania Mobile Money Market Segmentation: The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Technology:

- USSD

- Mobile Wallets

- Others

Breakup by Business Model:

- Mobile Led Model

- Bank Led Model

Breakup by Transaction Type:

- Peer to Peer

- Bill Payments

- Airtime Top-ups

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145