Digital Transformation Drives Financial Services Innovation

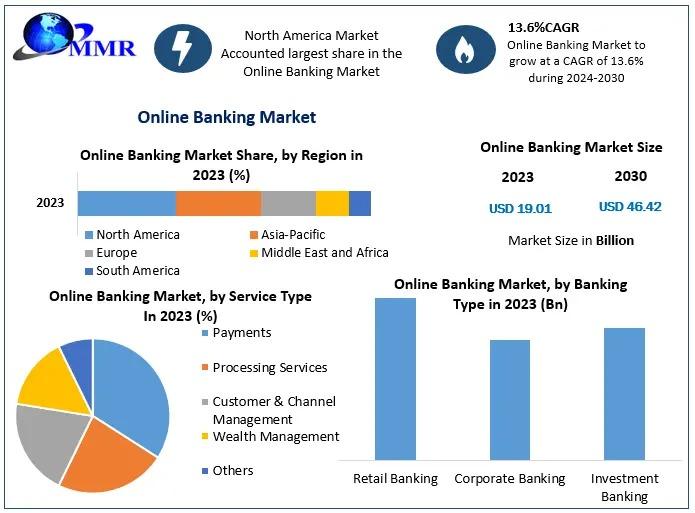

Online Banking Market Size is experiencing significant growth, with projections indicating an increase from USD 19.01 billion in 2023 to USD 46.42 billion by 2030, representing a robust compound annual growth rate (CAGR) of 13.6% during the forecast period. This surge underscores the transformative impact of digital banking solutions across the financial services industry.

Market Definition and Overview

Online banking, also known as internet banking or web banking, enables customers to conduct financial transactions via the internet. Services typically include account management, fund transfers, bill payments, and access to financial products, all accessible 24/7. This convenience has revolutionized traditional banking, offering customers greater flexibility and control over their financial activities.

Market Growth Drivers and Opportunities

Several key factors are propelling the expansion of the online banking market:

- Increased Internet Penetration and Smartphone Usage: The widespread availability of high-speed internet and the proliferation of smartphones have made online banking more accessible to a broader population, facilitating seamless financial transactions on-the-go.

FREE |Get a Copy of Sample Report Now: https://www.maximizemarketresearch.com/request-sample/84177/

- Consumer Demand for Convenience: Customers increasingly prefer the ease and flexibility of managing their finances online, driving banks to enhance their digital offerings to meet these expectations.

- Advancements in Digital Payment Solutions: The development of secure and efficient digital payment systems has bolstered the adoption of online banking, enabling faster and more reliable transactions.

- Regulatory Support for Digital Financial Services: Governments and regulatory bodies are implementing policies that encourage the growth of digital financial services, providing a favorable environment for online banking expansion.

Segmentation Analysis

The online banking market is segmented based on service type, deployment mode, end-user, and region.

- Service Type:

- Retail Banking: Services tailored for individual consumers, including savings and checking accounts, personal loans, and credit cards.

- Corporate Banking: Services designed for businesses, such as commercial loans, cash management, and merchant services.

- Investment Banking: Services related to capital markets, including wealth management, trading, and advisory services.

Get Your Free Sample Explore the Latest Market Insights: https://www.maximizemarketresearch.com/request-sample/84177/

- Deployment Mode:

- Cloud-Based: Online banking services hosted on cloud platforms, offering scalability and cost-effectiveness.

- On-Premises: Services hosted on the bank's own infrastructure, providing greater control over data security and operations.

- End-User:

- Individual Consumers: Personal banking services accessed by individuals for daily financial management.

- Small and Medium Enterprises (SMEs): Business banking solutions catering to the financial needs of SMEs.

- Large Enterprises: Comprehensive banking services designed for large corporations with complex financial requirements.

- Region:

- North America: Dominated by the United States and Canada, with a high adoption rate of digital banking services.

- Europe: Includes countries like the United Kingdom, Germany, and France, where online banking is well-established.

- Asia Pacific: Rapid growth in countries such as China, India, and Japan, driven by increasing internet penetration and smartphone usage.

- Latin America: Emerging markets in Brazil, Mexico, and Argentina are experiencing a surge in online banking adoption.

- Middle East and Africa: Growing interest in digital banking solutions, particularly in countries like the UAE and South Africa.

Competitive Analysis

The online banking market is characterized by the presence of several key players striving to innovate and capture market share. Notable companies include:

- JPMorgan Chase & Co.: A global financial services leader offering a comprehensive suite of online banking solutions for both retail and corporate clients.

- Bank of America Corporation: Provides a wide range of digital banking services, including mobile banking apps and online account management tools.

- Wells Fargo & Company: Offers online banking services with features such as bill pay, fund transfers, and account alerts.

- Citigroup Inc.: Provides online banking solutions with a focus on user-friendly interfaces and robust security measures.

- HSBC Holdings plc: Offers digital banking services with a global reach, catering to both individual and business customers.

- Barclays PLC: Provides online banking solutions with innovative features, including budgeting tools and financial planning resources.

- Royal Bank of Canada (RBC): Offers a range of digital banking services, including mobile banking and online investment platforms.

- Deutsche Bank AG: Provides online banking solutions with a focus on international transactions and multi-currency accounts.

- UBS Group AG: Offers digital banking services with a focus on wealth management and investment solutions.

- Standard Chartered PLC: Provides online banking services with a focus on emerging markets and cross-border transactions.

For additional reports on related markets, visit our website:

Global Blue Prism Technology Services Market Size Outlook

Global Disk Storage Systems Market Size Outlook

Conclusion

The online banking market is on a dynamic growth trajectory, driven by technological advancements, increasing consumer demand for convenience, and supportive regulatory environments. As financial institutions continue to innovate and enhance their digital offerings, online banking is set to become an integral component of the global financial landscape, transforming how individuals and businesses manage their financial activities.