Market Overview 2032

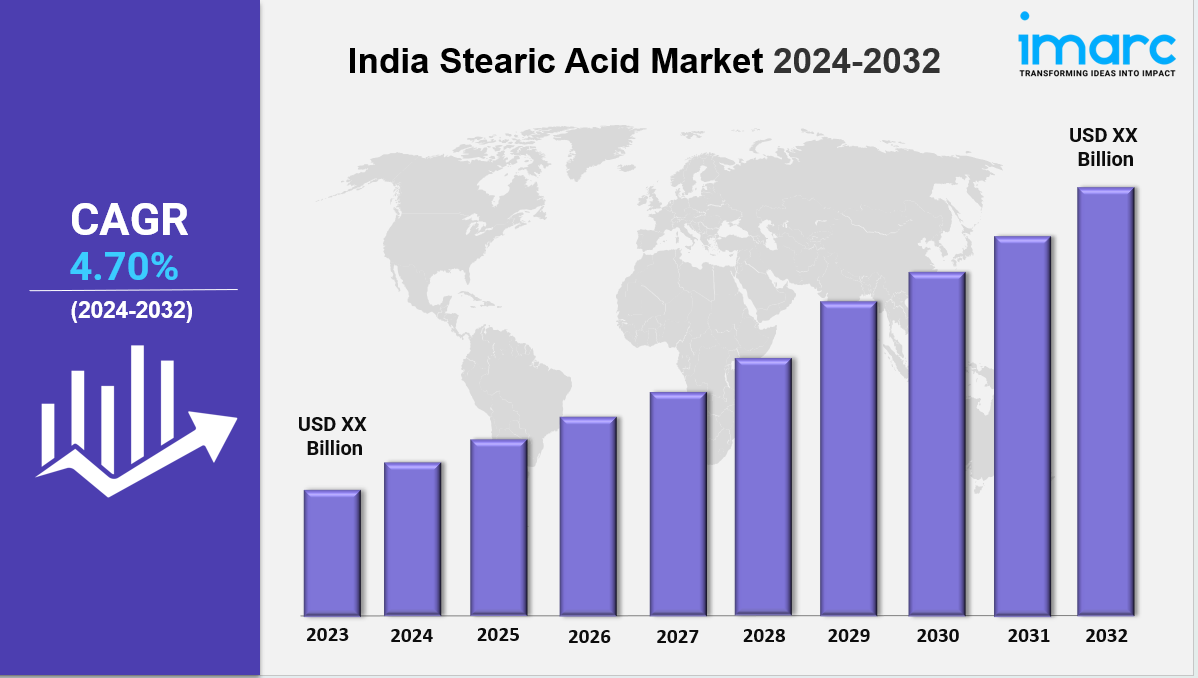

India stearic acid market size is projected to exhibit a growth rate (CAGR) of 4.70% during 2024-2032. The market is experiencing steady growth, driven by rising demand from industries such as cosmetics, personal care, and plastics. Its wide range of applications, along with growing industrialization and manufacturing, are key factors contributing to the sector’s expansion.

Key Market Highlights:

✔️ Steady market growth driven by increasing demand from personal care, cosmetics, and industrial sectors

✔️ Rising usage in soaps, detergents, rubber, and pharmaceutical applications

✔️ Expanding focus on sustainable and bio-based stearic acid production

Request for a sample copy of the report: https://www.imarcgroup.com/india-stearic-acid-market/requestsample

India Stearic Acid Market Trends and Driver:

The market for stearic acid in India is being greatly boosted by the country's personal care and cosmetics industries' explosive growth. The need for emulsifiers, thickeners, and surfactants is growing as consumers gain more awareness about skincare and grooming; stearic acid is a crucial ingredient in many cosmetic compositions. Manufacturers frequently use stearic acid because it is crucial for stabilizing and enhancing the texture of creams and lotions.

Additionally, the increasing demand for natural and organic products is driving the India stearic acid market share. Since stearic acid can be derived from plant-based sources, it appeals to eco-conscious consumers. The growing reach of e-commerce platforms has further expanded access to beauty products, leading to increased demand for stearic acid in cosmetic formulations across the country.

The applications of stearic acid go beyond the personal care industry and support the expansion of the stearic acid market in India as a whole. Stearic acid is used as a food additive in the food processing industry, especially in goods that include fat, such as shortening and margarine. It enhances texture and shelf life by stabilizing and emulsifying. The demand for premium stearic acid is anticipated to increase due to urbanization and changing lifestyles, which will fuel the expansion of the Indian stearic acid market.

The regulatory landscape for stearic acid in India is becoming more stringent as global trends push for sustainability and environmental responsibility. Regulatory bodies are enforcing stricter guidelines on sourcing and manufacturing chemical products, including stearic acid. Consequently, manufacturers are adopting sustainable practices, such as utilizing renewable resources and reducing production waste, to comply with these standards.

Growing consumer awareness of environmental impacts is also encouraging demand for sustainably sourced stearic acid. Companies that align with these eco-friendly values can gain a competitive edge by attracting environmentally conscious consumers.

In conclusion, the evolving regulatory environment and sustainability efforts are shaping the future of the India stearic acid market. One notable trend is the shift towards bio-based and renewable sources of stearic acid. By 2024, manufacturers are expected to focus on plant-derived materials to meet both consumer demand for greener products and regulatory pressures. This shift will not only address environmental concerns but also appeal to health-conscious consumers seeking natural ingredients.

Moreover, the rise of the vegan and cruelty-free movement is influencing product formulations, with stearic acid playing a vital role in many vegan cosmetic and personal care products. The growing food industry, particularly the processed foods sector, is another key driver of stearic acid demand.

As technological advancements improve the production efficiency and quality of stearic acid, it is becoming more accessible across various industries. These trends position the India stearic acid market for significant growth and innovation in the coming years, driven by consumer preferences, regulatory developments, and industrial progress.

India Stearic Acid Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2023

Historical Year: 2018-2023

Forecast Year: 2024-2032

Breakup by Type:

- Vegetable Based

- Animal Based

Breakup by End User:

- Soaps and Detergents

- Rubber Processing

- Textiles

- Personal Care

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145