Market Overview 2025-2033

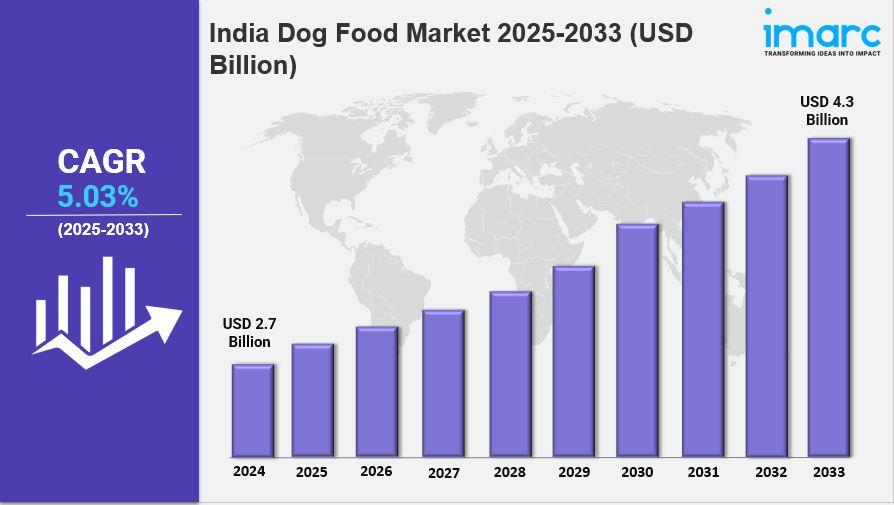

The India dog food market size reached USD 2.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.03% during 2025-2033. The India dog food market is experiencing significant expansion, driven by a growing awareness of pet nutrition, the rise in pet ownership, and an increasing focus on premium products. Key trends include a heightened consumer interest in specialized diets and natural ingredients, as both emerging brands and established players emphasize quality and health benefits to cater to diverse canine needs. This shift towards nutritious and tailored options is promoting greater adoption and enhancing the overall well-being of pets across the country.

Key Market Highlights:

✔️ Rapid growth fueled by increasing pet ownership and awareness of proper nutrition for dogs.

✔️ Rising consumer interest in premium and specialized dog food products tailored to specific health needs.

✔️ Strong focus on natural ingredients and transparency in sourcing to enhance trust and brand loyalty among pet owners.

Request for a sample copy of the report: https://www.imarcgroup.com/india-dog-food-market/requestsample

India Dog Food Market Trends and Driver:

The India dog food market is poised for significant growth, reflecting a broader trend of increasing pet ownership and the humanization of pets. As more households welcome dogs as family members, owners are becoming more conscious of their pets' dietary needs. This shift is driving a demand for high-quality, nutritious dog food that caters to various health requirements. The market is expected to expand rapidly, with projections indicating a substantial increase in the India dog food market size over the next few years.

One of the key trends shaping the landscape of the India dog food market is the rising popularity of premium and specialized food products. Owners are increasingly opting for grain-free, organic, and holistic options, prioritizing ingredients that promote overall health and well-being. This trend is further fueled by the growing awareness of pet nutrition and the potential health issues associated with poor dietary choices. As a result, brands are innovating to offer a diverse range of products, including breed-specific and age-specific formulations, which cater to the unique needs of dogs at different life stages.

In 2025, the India dog food market share is expected to reflect a significant shift towards online retail channels. E-commerce platforms are becoming a preferred shopping avenue for pet owners, offering convenience and a wider variety of products. This shift is not only changing purchasing behaviors but also encouraging brands to enhance their online presence and engage with customers through digital marketing strategies. The rise of subscription services for dog food is also gaining traction, providing customers with hassle-free delivery options and fostering brand loyalty.

Additionally, sustainability is becoming an essential consideration in the India dog food market. Consumers are increasingly seeking brands that prioritize eco-friendly packaging and ethically sourced ingredients. This trend aligns with the broader global movement towards sustainability and responsible consumption. As awareness grows, companies are adapting their practices to meet these expectations, which may influence market dynamics and consumer preferences moving forward. Overall, the India dog food market is set for a transformative journey, driven by evolving consumer demands and a commitment to enhancing the health and happiness of pets across the nation.

India Dog Food Market Segmentation: The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2020-2024

Forecast Year: 2025-2033

Breakup by Product Type:

- Dry Dog Food

- Dog Treats

- Wet Dog Food

Breakup by Pricing Type:

- Premium Products

- Mass Products

Breakup by Ingredient Type:

- Animal Derived

- Plant Derived

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145