Wealth Management Platform Market Overview

Market Size & Growth

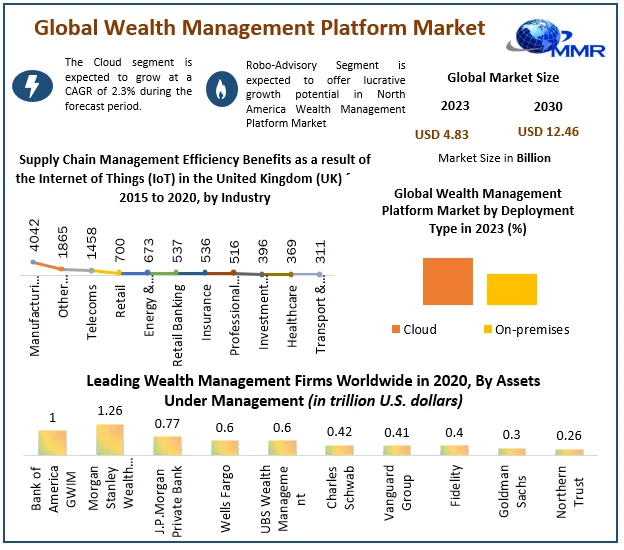

The Wealth Management Platform Market was valued at approximately US$ 33 Bn. in 2023. The industry is projected to expand at a compound annual growth rate (CAGR) of 12.7% from 2023 to 2030, reaching nearly US$ 76.2 Bn. by the end of the forecast period.

Industry Insights

The Wealth Management Platform Market report aims to provide current market intelligence and assist decision-makers in making informed investment choices. It offers a detailed analysis of market trends based on product type, applications, key manufacturers, and regional distribution.

For a sample report, visit: https://www.maximizemarketresearch.com/request-sample/63945/

Market Scope

This report evaluates the growth prospects, challenges, and industry trends influencing the Wealth Management Platform market. Porter’s Five Forces Analysis is utilized to examine factors such as supplier bargaining power, competitive landscape, and market dynamics.

Market Segmentation

by Deployment Type

Cloud

On-premises

by Advisory Model

Human Advisory

Robo-Advisory

Hybrid

by Application

Performance Management

Risk and Compliance Management

Financial Advice Management

Portfolio accounting and Trading Management

Reporting

Other

by End-User

Investment Management

Firms

Trading and Exchanging firms

Banks Brokerage Firms

Other

For an in-depth market report, click here: https://www.maximizemarketresearch.com/market-report/global-wealth-management-platform-market/63945/

Key Market Players

Prominent companies in the Wealth Management Platform Market include:

Major Contributors in the Wealth Management Platform Market in North America:

1. Charles Schwab Corporation (San Francisco, California, USA)

2. Fidelity Investments (Boston, Massachusetts, USA)

3. Vanguard Group (Malvern, Pennsylvania, USA)

4. BlackRock, Inc. (New York, USA)

5. Morgan Stanley (New York, USA)

6. Merrill Lynch (New York, USA)

7. Goldman Sachs Group, Inc. (New York, USA)

8. J.P. Morgan Chase & Co. (New York, USA)

9. Wells Fargo & Company (California, USA)

10. TD Ameritrade Holding Corporation (Nebraska, USA)

11. LPL Financial Holdings Inc. (California, USA)

12. Ameriprise Financial, Inc. (Minnesota, USA)

13. Raymond James Financial, Inc. (Florida, USA)

14. SEI Investments Company (Pennsylvania, USA)

15. Northern Trust Corporation (Illinois, USA)

16. BNY Mellon Wealth Management (New York, USA)

17. Stifel Financial Corp. (Missouri, USA)

Major Leading Player in the Wealth Management Platform Market in Asia Pacific:

1. Charles Stanley Group (London, United Kingdom)

2. Deutsche Bank Wealth Management (Frankfurt, Germany)

Regional Analysis

The market is analyzed across the following regions:

-

North America: United States, Canada

-

Europe: Germany, France, United Kingdom, Russia

-

Asia-Pacific: China, Japan, Korea, India, Southeast Asia, Australia

-

Latin America: Brazil, Argentina, Colombia

-

Middle East & Africa: Saudi Arabia, UAE, Egypt, South Africa

Key Questions Addressed in the Report

-

What are the emerging trends in the Wealth Management Platform market during the forecast period?

-

What will be the market size by 2030?

-

Which company holds the largest market share?

About Maximize Market Research

Maximize Market Research is a leading market research and consulting firm specializing in various industries, including medical devices, pharmaceuticals, technology, automotive, chemicals, and more. Our services encompass market forecasting, competitive analysis, strategic consulting, and consumer impact studies.

Contact Us:

Maximize Market Research Pvt. Ltd.

-

Address: 3rd Floor, Navale IT Park Phase 2, Pune-Bangalore Highway, Narhe, Pune, Maharashtra 411041, India.

-

Phone: +91 9607365656

-

Email: [email protected]

-

Website: Maximize Market Research